Post Dated Cheque is a future payment Receipt given today. Like we

can get the payment on future. But the cheque we can get it from the

customer today or give cheque to supplier today. On the maturity Date

the Supplier will collect it from Bank or we have to collect our

customer cheque on the same way. This is two sides we can mange it.

- Post Dated Cheque from Customer

- Post Dated Cheque to Supplier

From Customer

We

are receiving cheque for multiple invoices from our customer with date

of future, We can't collect this payment today. We can collect this

cheque on the date given in cheque. So in our system, We can able to

store these informations and helps you to notify the expiring cheques.

So it can be collected on the date and allocated the specified invoices

to it.

To Supplier

For

your suppliers, You can provide a similar way of future dated cheque. So

on the date the supplier will collect payment and allocate specified

invoices for it. We need notification to cheque that on this date, we

should have the balance of the cheque given or more than that to avoid

credit risks.

Let's take a look at each of them

with our TamilAccounting Implementation. This is a custom app. So this

app will be installed based on the request from your side.

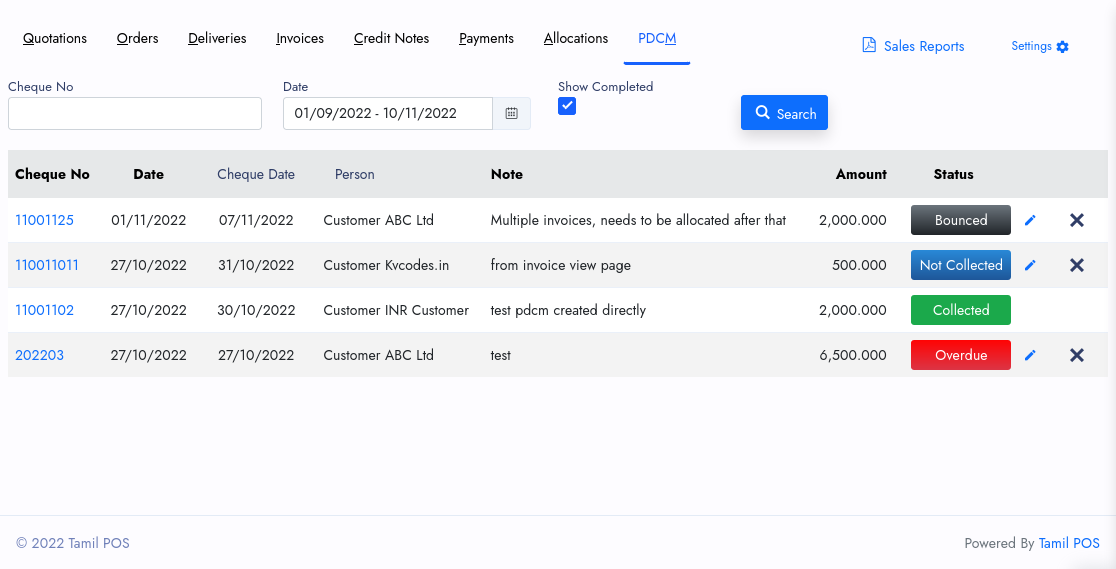

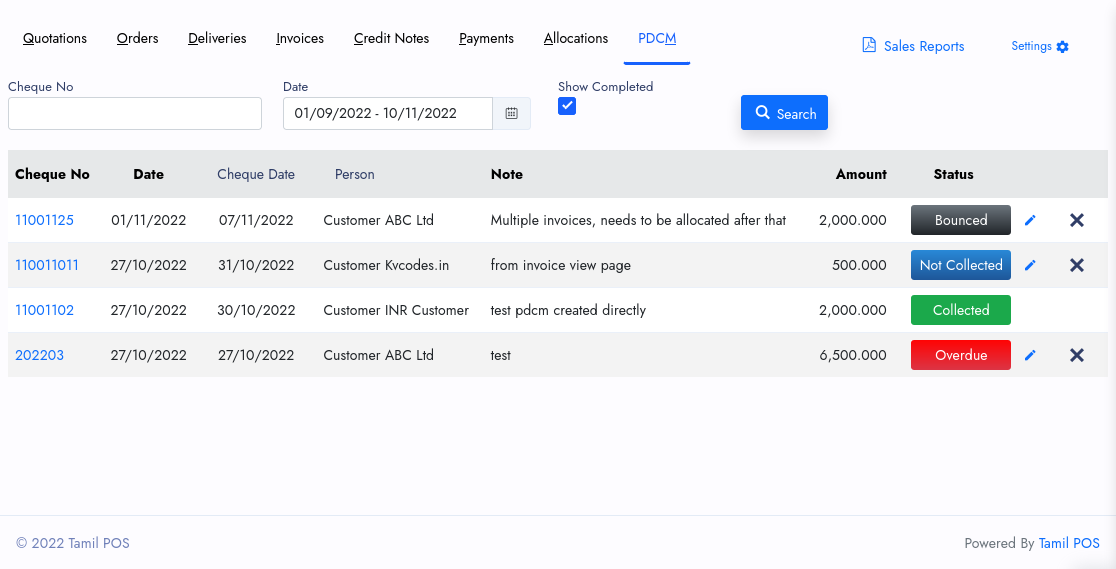

Sales

There

are two ways to add Cheque information in sales, When you receive a

cheque from your customer for a specific invoice. View that specific

invoice from the view page you can a new button named PDC.

And

this PDC come with a popup. there you can feed the information of

cheque amount and date to be collected. After that you can able to add

more invoices into it, Suppose if they have given cheque for multiple

invoices. we can add those invoice information along with amount left to

allocate from it,

From the View page you can add more than one invoice for a cheque. and the allocation balance will show like this.

With

this you can able to perform the allocation and create a customer

Payment in it. You need to choose the right bank account, Date, and

Payment type. Than proceed to Complete the Payment. After that the

Payment view link appears and Status of PDC changed to Completed or

Collected.

We are also showing the PDC

Allocations in the invoice view popup. so you can able to view the

respective cheque Allocations and payment balances.

Purchases

On

the Purchase side, its like similar process. But a little differences.

You are the cheque issuer and Your Supplier is collecting the cheque. So

you need to decide the cheque information like amount, date, and

allocation of invoices.

And of-course you need to print the Cheque with our Report Printer.

This helps to print the cheque, There is a Print Cheque on the top of the supplier PDC View And you can adjust the position of texts with help of our editor.

And it of-course you can reprint the cheque and you can update the cheque number in our system. And ofcourse in the Listing of PDC available on the Sales and Purchase pages inside as Tabs.