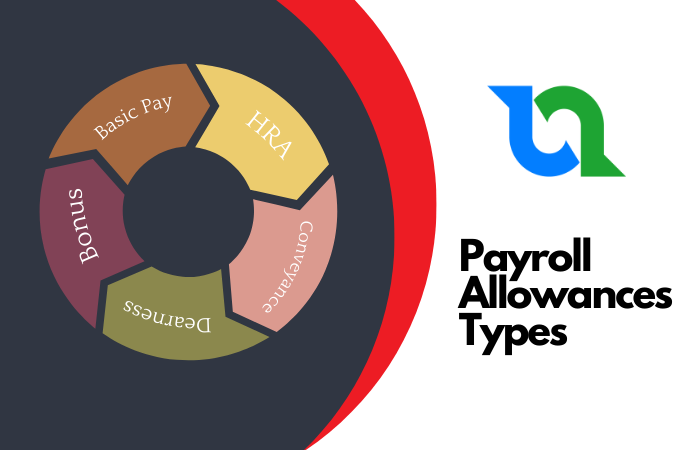

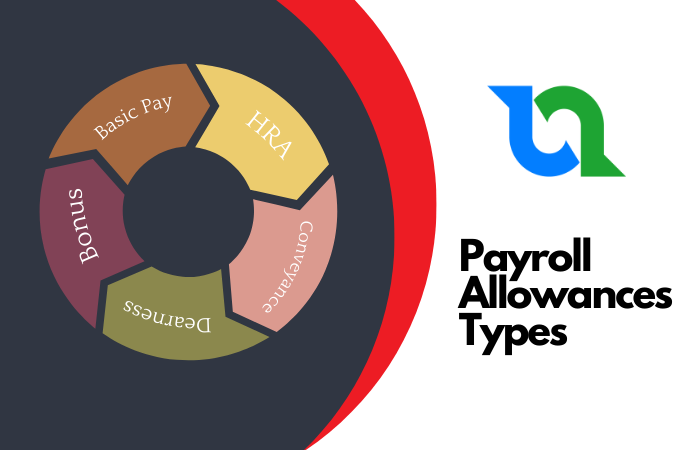

The Payroll Allowance types are classified into many factors.

- Taxable

- Non-taxable

- Reimbursement

- Bonus

- Benefits

- Cost to the company

- Deductions

- Earnings

Let's check them one by one.

Taxable Allowance

It has to be taxed and the employee has to be pay taxes from his salary components. Allowances such as Basic pay, Dearness, Conveyance, House Rent, Education, etc.

Non-Taxable Allowance

Allowance which are like incentives and other bonus, special allowances, which are not taxed to the employees. in some cases, the government employees and senior employees are not charged with taxes.

Reimbursement

It's kind of encouraging allowance to the employees, like Travel, Telephone, Interest, Petrol, etc. Which are all reimbursement and connects to the payroll on monthly basis. its custom and varies each month based on certain factors. or fixed based on some formulas.

Bonus

This is almost similar to the Reimbursement, which helps to encourage the employees, It can be offered festival, or any success sharing, or special thanking though this.

Benefits

This is non cash allowance, which employee receive benefits like travel with business class, get free travel accommodation, It can be served mainly for government employees and privileged employees in a private company.

Cost to the company

which is also popular called as CTC. This is additional expenses for an employee, which company spends on them, like Insurance, medical benefits, accident and permanent or temporary disablement with benefits.

Deductions

Its deduction part such as Loss of pay, Taxes, Employee contribution on insurances, Advance Salaries, Loans, and etc.

Earnings

It's combination of Taxable, non-taxable, Reimbursement, and benefits, Which can be differ company to company, mainly it starts with benefit to the employees.

These are all the allowance types, which i know from the best of my experience.