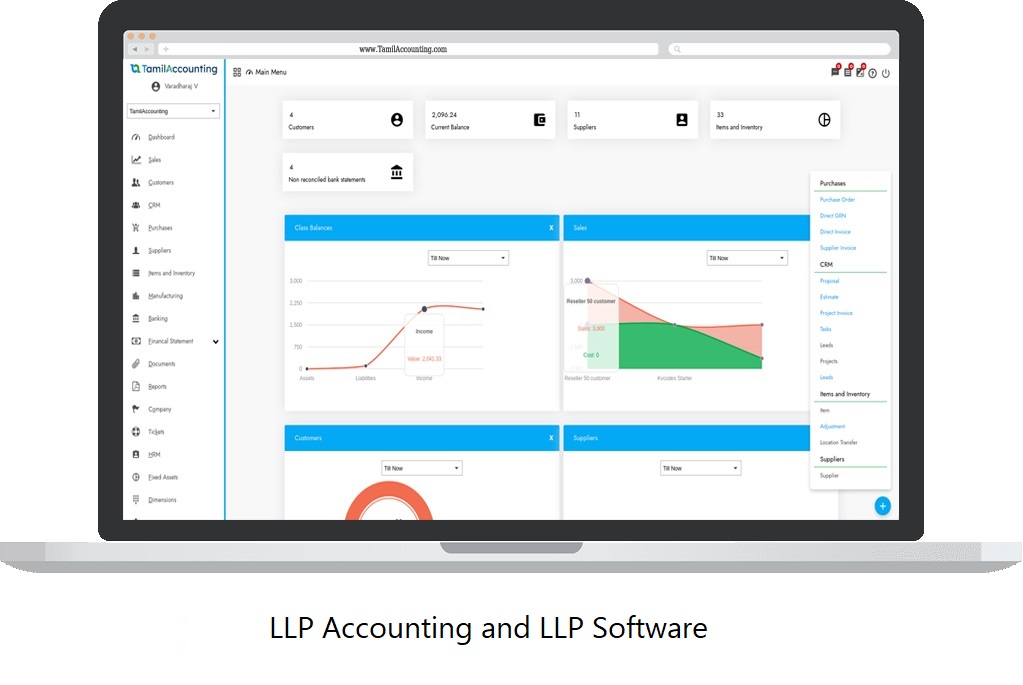

The Limited Liability Partnership(LLP) has a limit of liability and which will be expressed clearly during the partnership and the liability should be balanced all time. It has to maintain the record clearly. Those who are operating the LLP, They should have a perfect accounting software to maintain its credibility clearly and the software will help you to know the situation anytime. If you have the Software on cloud, you can monitor it anytime, and the Access also shared among the partners and which will help them to go on a mutual understanding between them.

Responsibility

The LLP should maintain an accountant to handle all the operations clearly. They have certain responsibility to maintain it. Let's take a look at the responsibility that the Accountant have it for LLP.

- Capital Investments from partners

- Shares and common shares

- Payables and Receivables

- Assets and liabilities

- Stock balances

- Book keeping of Expenses and revenues generated.

- Ofcourse Taxes and TDS

- Payroll and Employee Remunerations

Most of the Accountants prefer Software's to handle it. Now a days most of the accounting firms looking perfect software's for their jobs. And ofcourse the bookkeeping is not a easy job, it requires to maintain it clearly.

Accounting on Cloud

The Cloud accounting is more helpful for them to maintain and check it from anywhere. Nowadays most of the governments and tax portals are requesting the Cloud software's and connect the portal through the API way to perform the Taxations.

e-Invoice

This is another great feature to handle the invoice between customer and suppliers. And its easy to connect payment gateways and collect the payments easily with it.